Aging is an issue that impacts every American family. Americans are doing many things to improve their health to age gracefully, but we are not always successful. With longevity comes a decline in our health, body, and mind.

Professional long-term health care costs are rising rapidly due to increased demand for care services and higher labor costs. Family caregivers face physical and emotional pressure. LTC Insurance can be the solution.

Addressing the consequences of longevity and the physical and cognitive problems it creates is a significant retirement planning concern. There will be financial and family pressure when you need long-term health care, especially if you have not planned for it in advance.

The problem of long-term care is both a cash flow issue and a family issue. Ignoring the problem has a tremendous impact on your family and finances.

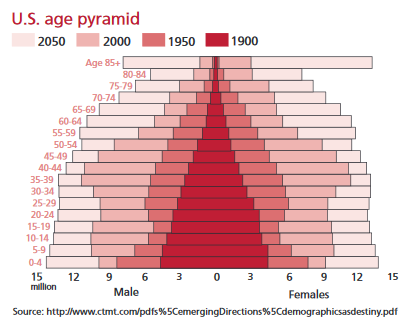

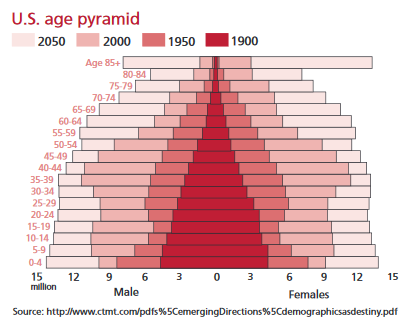

The facts are daunting. One in every five Americans will be considered a senior citizen by the year 2030. By the year 2040, more than 14 million Americans will be 85 or older. The large number of people aging in America creates a vast potential crisis for the American family.

The MacArthur Foundation reports the dramatic increase in life expectancy in the United States is one of the most significant cultural and scientific advances in our history.

Health Issues Increase With Age

The Health in Aging Foundation reports one in eight adults are over age 65.

They report as we get older, we tend to develop health conditions. Over half of this group suffers from three or more chronic diseases. These include heart disease, arthritis, diabetes, cancer, and high blood pressure, to name a few.

Many of these people end up requiring help with routine activities of daily living. These daily living activities are the things we take for granted today that we learned how to do as an infant. But, at some point, we will need help with these daily living activities every day because of an illness, accident, or the impact of aging.

These activities include bathing, eating, dressing, moving from one place to another, and bathroom activities.

Don’t forget, as we age, there is a higher risk of cognitive decline from Alzheimer’s or other forms of dementia. We may be healthy in every other way but will require some sort of supervision due to memory loss.

“Currently, it (Alzheimer’s) is 100% incurable and it is 100% fatal,” said John Feather, PhD, CEO, Grantmakers in Aging and former Chair of American Society on Aging’s Board of Directors

In a recent blog, Susan Coronel, Executive Director, LTC, America’s Health Insurance Plans (AHIP) wrote:

“Long-Term Care (LTC) coverage can help ensure that we successfully care for this generation. LTC coverage helps to pay for services that many seniors will need as they age, including board and care in a residential home; the support of a caregiver who would help with daily activities such as bathing, dressing, and eating and care for long-lasting or recurring illnesses.”

Medical Advances Mean More Extended Care at All Ages

While many of us will require long-term care services and supports as we get older, the advances in medical science have created more younger people who need extended care services, so long-term health care is not limited to just the elderly.

AHIP says the need for long-term care services impacts people of all ages, not just for seniors. AHIP says approximately 20 million Americans each year under the age of 65 need long-term care services and supports to help them and their families deal with a serious illness, health condition, or accident.

AHIP is advocating Congress to take a few simple steps to encourage more people to plan for the financial costs and burdens of aging. As more people plan in advance, it will provide more financial protection to American families and their future retirements. It will also protect welfare programs, like Medicaid, so that they will be available for the truly poor.

Action Items for Congress

AHIP is asking Congress to act on the following:

- Allow employees to use “cafeteria plans” and “flexible spending accounts” to buy Long-Term Care Insurance (usually on a pre-tax basis). AHIP says that allowing Long-Term Care Insurance to be purchased under such pre-tax plans will make it even more affordable. The law already allows individuals to use pre-tax money in Health Savings Accounts to pay for these policies.

- Allow retirement plans to invest directly in Long-Term Care coverage. AHIP says this improvement will allow Americans to treat their Long-Term Care coverage like any other retirement plan investment. The impact on seniors’ tax revenue would be minimal because they would be using existing retirement plan savings to protect themselves from these expenses.

- Allow employees to make additional contributions to their Health Savings Accounts (HSA) to pay for Long-Term Care Insurance plans. This allows employees to save more pre-tax dollars to buy Long-Term Care coverage for themselves and their spouses.

AHIP says that encouraging people to invest now to cover future long-term health care expenses will likely save more taxpayer dollars in the long term.

Tax Incentives Available for Long-Term Care Insurance

The federal government also has several tax incentives available for some people. Some states also offer state tax incentives. Most states offer Long-Term Care Partnership plans, which provide additional dollar-for-dollar asset protection.

The LTC NEWS tax guide is a helpful resource - just click here.

- You can find what is available in your state and find the current and future cost of long-term care services by using the LTC NEWS Cost of Care Calculator. Click here and find your location.

“By enacting these solutions, Congress can ensure that seniors are provided with an important pathway to health, independence, and financial security,” Coronel said.

Experts say planning prior to retirement gives consumers more choices as well as much lower premiums.

“This has become a fundamental part of retirement planning. Most people who contact me about Long-Term Care Insurance planning are in their 40s and 50s. While affordable options exist for those older, it is your relatively good health, today, that gives you the ability to plan for the financial costs and burdens of aging,” said Matt McCann, a leading expert on Long-Term Care Insurance and planning.

Today's LTC Insurance is Affordable and Rate Stable

Today's Long-Term Care Insurance is not only affordable but also rate stable. A recent study completed by the American Association for Long-Term Care Insurance (AALTCI) says there is only a small risk of future premium increases for today's Long-Term Care Insurance.

The AALTCI report, which surveyed industry actuaries, shows confidence in the industry pricing models based on updated regulation, interest rates, and underwriting expertise.

Many states have rate stabilization rules which provide additional consumer protections. Find your state by clicking here. Plus, today's Long-Term Care Insurance plans are priced based on the low-interest rate environment.

“I believe the risk of future rate increases is zero,” said Jesse Slome, director of the AALTCI. “Rising interest rates and the new regulations mean someone purchasing a new Long-Term Care Insurance policy in 2018 and 2019 faces little if any chance of a future rate increase.”

“Many of my clients are addressing the need for long-term care planning while in their prime working years. They are happy to learn they can use their Health Savings Accounts (HSA) to further offset some of the premium cost each year. I know my clients with Flexible Spending Accounts (FSA) would love to be able to take advantage as well, so we would definitely look favorably upon any expansion to the existing tax incentives for Long-Term Care insurance.,” said Cassandra Watson, a Long-Term Care Specialist who runs NextGen Long-Term Care Planning.

With or without additional incentives from Congress and the White House, Long-Term Care Insurance provides essential financial protection and, at the same time, reduces the tremendous stress and pressure placed on family members as you get older.

Experts remind us that caregiving is hard on loved ones, and paid care will drain or wipe out retirement accounts and impact income and lifestyle.

Seek Planning Help from Specialist

The AALTCI recommends working with a Long-Term Care Insurance specialist who represents the major companies in the industry. This way, the specialist can assist you with understanding policy design, underwriting, and determining if a partnership plan is your best option.

LTC NEWS can help you find a qualified and trusted specialist by clicking here.

There are several types of policies available. A specialist can help you choose the best one which fits your specific situation. Remember, every insurance company has its individual pricing and underwriting criteria. Premiums can vary over 100% between insurance companies for the same benefits.

“This is not just good public policy. It provides key asset protection and peace-of-mind,” McCann added.

Many insurance companies offer policies that can cover extended care services. You can review and compare the major insurance companies that offer long-term care solutions by clicking here.