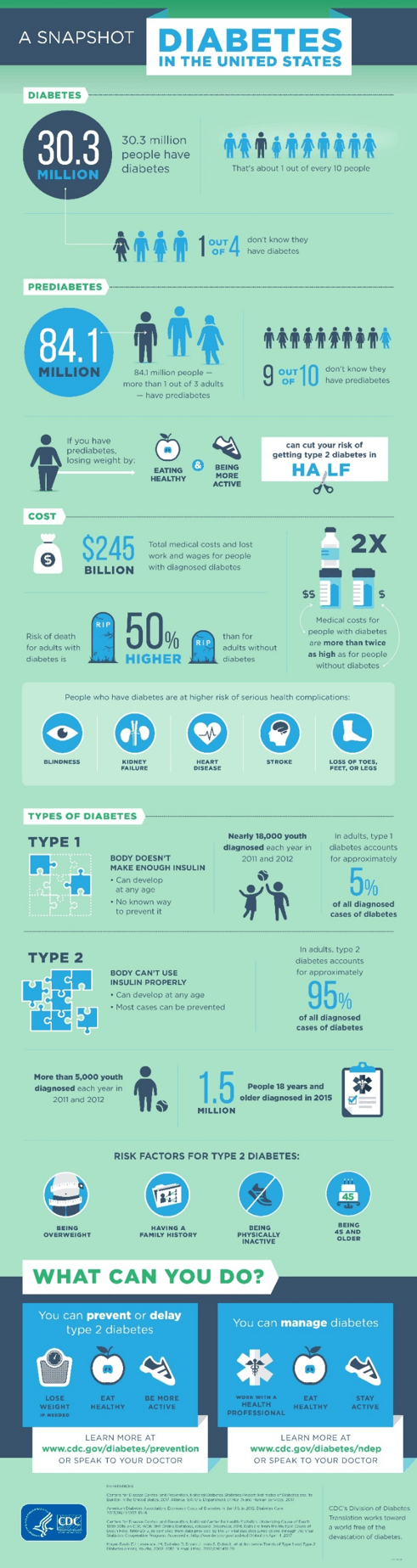

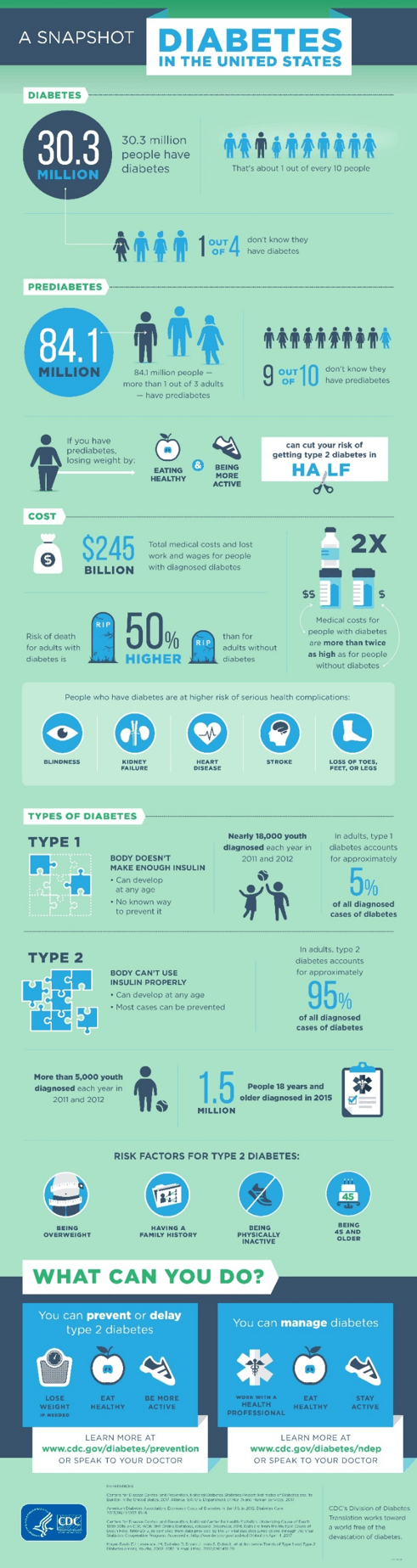

Millions of people around the world are living with diabetes or prediabetes. More than 100 million people are living with diabetes in the United States alone. That means that most of us have been touched by this disease somehow, whether we have diabetes ourselves or know a loved one who’s living with it.

The disease made the news again after being linked to the death of the beloved actress and director Penny Marshall. However, diabetes has long been a leading cause of death globally. Luckily, it doesn’t have to be such a grim diagnosis. With proper medical care and healthy habits, it’s possible to manage the symptoms of diabetes and even prevent diabetes from developing in the first place. If you or a loved one are a senior living with diabetes either type 2 or type 1 diabetes, keep reading for some tips on how to ensure the best possible care for diabetes.

Testing and treatment

One of the most critical aspects of managing diabetes is getting the proper tests and treatments. Diabetes is often treated through a combination of sugar level monitoring, diet, exercise, and taking appropriate medications as prescribed. You’ll work with your doctor to create a treatment plan that’s right for you. Talk to your doctor about blood glucose tests, lifestyle adjustments, and any medications or other treatments you’ll need to help manage your condition. You might also ask about any potential clinical trials that could be beneficial to you.

Issues Related to Diabetes

In addition to affecting your health, diabetes can also affect your vision. That’s why it’s crucial for everyone, especially seniors living with diabetes, to obtain the proper level of health care coverage so treatments are covered and affordable.

Deciding which health insurance plan to choose can be tricky, especially for the 25 percent of seniors over 65 who are living with diabetes. Luckily, Medicare Advantage plans offer certain types of coverage, including vision and dental, that might not always be covered by Medicare alone.

Before purchasing a plan, do some research about the different options that are available through providers like Aetna. That way, you can determine whether you or your senior loved one might benefit from Medicare Advantage before choosing the perfect plan.

Not-So-Good Days

Mayo Clinic recommends creating a proactive plan for how you’ll handle any days when you’re not feeling well. Your plan should include written instructions for “what medications to take, how often to measure your blood sugar and urine ketone levels, how to adjust your medication dosages, and when to call your doctor.”

You should also ask your doctor for dietary recommendations, safe exercises, and other ways you can modify your daily routine. For instance, you’ll want to eat balanced meals with the right proportion of carbohydrates and make sure you’re eating enough food before taking your medications. By making small, proactive lifestyle changes, you can take your health into your own hands and help keep your symptoms under control.

The Supply Situation

As you plan for your long-term health, you should also consider any diabetic supplies you’ll need to manage your care. Compare the prices of test strips at your local pharmacies as well as online. If you’re having trouble paying for diabetes supplies that aren’t covered by your health insurance, you might want to reach out to a diabetes charity or nonprofit for assistance. Some diabetes charities, such as the Charles Ray III Diabetes Association, provide income-based assistance to diabetic patients.

Whatever decisions you make regarding your health or the health of your senior loved ones, it’s important to weigh your options. Conduct proper research and compare the different health plans that are available to you.

Ensure you have the coverage you need for any necessary tests, treatments, supplies, or wellness plans. Remember, although diabetes can be a tough diagnosis, it doesn’t have to define your life. By monitoring your blood sugar and caring for your health, it’s possible to maintain wellness at any age.

Diabetes Leads to High Risk of Long-Term Health Care

Keep in mind diabetes makes any future health problem more complicated. These complications include a higher risk of needing long-term health care. Most long-term care services are not covered by health insurance, including Medicare and supplements.

Medicaid will pay for long-term care services, but you must have little or no assets to qualify. Long-Term Care Insurance will pay for these expenses, but you must obtain coverage before your diabetes progresses as you might become uninsurable.

It is best to obtain Long-Term Care Insurance in your 40s or 50s when your overall health is usually much better, and premiums are lower. Seek the help of a licensed and qualified Long-Term Care specialist who works with the top companies. Underwriting rules vary, as do premiums, between companies. Those with diabetes will have a more difficult time getting coverage, but if your A1C is acceptable and you have few or no other significant health problems, you should be able to get affordable coverage.

Find a specialist by clicking here.

Photo courtesy of Unsplash